Michael E Potter of Harvard Business School in the year 1979 developed Porter's five-force analysis. It was developed as a simple framework for assessing and evaluating a business establishment's competitiveness by analyzing the company's strength and position. Michael Porter designed many vital frameworks for organizational strategy, but Porter's five force model received the most fame and is implemented to date.

What are the five forces of competition?

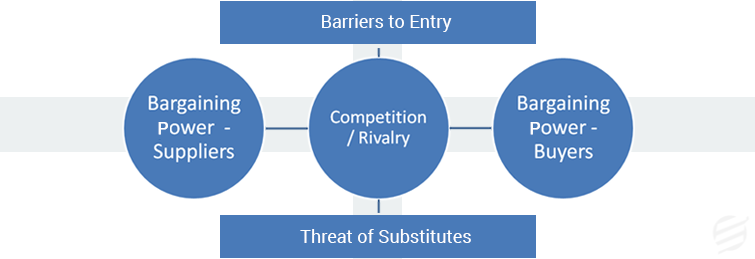

In the words of Porter, the nature of any competition in an organization can be epitomized by the following five points:

- Bargaining power of suppliers

- Bargaining power of buyers

- Threat from potential new entrants

- Threat of substitutes

- Rivalry in the industry

Michael Porter's five force model

What is the meaning of competitive forces?

Porter's competitive analysis model explained.

- The threat of new entrants: Your monopoly or the share you enjoy in a market can be significantly impacted if it is easy for your competitors to enter the market. If entry into your market is easy, in other words, there are only a few economies of scale; then your position in the market is at risk. If your crucial technology is easy to substitute, the chances of new entrants entering your market and weakening your position increase considerably.

- Bargaining power of customers: Over here, you determine the capacity of the customer to bargain the price of your product. Here, you look at the options available to the buyer and how easy it is for them to switch from your product to the competitors. If you are doing business with only a few influential buyers who provide the most revenue to your company, in such a case, the buyer can always dictate the price to you.

- The threat of substitutes: If your competitor is selling the exact product you are selling, this can pose a severe threat as any significant change in the product or the price can motivate the consumer to migrate from your product to the competitors. A few examples – if you are selling something that your competitor can substitute or can be done manually, the customer could move away from your product to do it manually as it would cost less.

- Bargaining power of suppliers: The force analysis takes note of how much power the supplier has to escalate the price of the raw material; this can happen when the number of suppliers is limited, and the material they are supplying is rare and difficult to obtain; in a situation like that the supplier would have dominion over the price and ultimately you.

- Competitive rivalry: The critical thing here is the competitors' number and capacity. If the number of competitors is huge and all of them offer goods and services that are on par with what you offer, then in such a situation, you will have little power over the buyers and the suppliers; if they are not satisfied with you, then they could abandon you without a second thought. But, if the situation were reversed, you would almost enjoy a relevant monopoly in the market.

A case study using Porter's five force analysis

Apple enjoys a good market share, but its strategy mainly addresses the external business environment. It faces stiff competition in the range of products it markets. Apple has created a unique brand symbol that the customers recognize. Porter's five force analysis of Apple:

Competitive rivalry: Apple faces a strong force of competition from rivals like Samsung, Sony, and Microsoft. The competition comes from innovation, aggressive advertising, and imitation. The low-price competitors offer it easy for customers to switch from Apple to its competitors. This part of Porter's five force model shows that rivalry is a severe factor for Apple.

Bargaining power of customers: The bargaining power of Apple customers is vital as it is straightforward for them to switch from Apple to its rivals, so Apple has to ensure complete customer satisfaction; on the other hand, at the individual level, the customer's power is weak as each buyer forms a very minute portion of Apple's total revenue.

Bargaining power of suppliers: The force of suppliers is weak as Apple has many options worldwide. Currently, Apple has less than 200 suppliers, but if it chooses, it can dump any supplier whenever it desires. So, this part of Porter's five-force analysis proves that Apple doesn't need to worry about the bargaining power of suppliers.

The threat of substitutes: In this area, the reserves have a weak force, even though a lot of replacements are available – a customer can use a digital camera instead of an iPhone or use a landline instead of an Apple phone, but the experience won't be the same. Thus, Apple doesn't need to worry about the substitution.

The threat of new entrants: Apple has a very moderate threat from competitors. To compete with Apple, a company would require massive capital, technical experience, and advanced technology.

Porter's five force analysis is an essential tool for assessing the risk a business could face in the future; it analyses all the present parameters and gives a glimpse into the future, providing the managers with enough information to take precautionary measures.