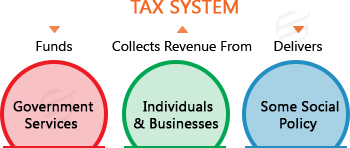

We all are very much aware of taxation, it is the duty or payment levied on an individual or an entity by the government. A certain percentage of the income is retrieved by the government, this money is used for infrastructure development and other initiatives taken by the government. Failing to do so or tax evasion is a punishable crime with the chances of imprisonment. The taxation in the United Kingdom changes every year under the law called Finance Act.

The demand for smart tax evaluators is on the rise, with the increasing complexity of the UK taxation this phenomenon was inevitable. The UK taxation has doubled in pages since 1997, it is now 11,520 pages. UK taxation is one of the world's most complex taxation systems. It is almost impossible for a student to obtain the highest grade in their tax assignment, given the complexity and the sheer volume of the subject. We here at EssayCorp are a specialist in UK taxation assignment help. We have provided taxation assignment help to numerous students from all over the country. We pride ourselves on our assignment writing service. We provide top-notch assignment help. Our UK native writers are specialized in their subjects and they are highly qualified as they hold Ph.D. degrees from recognized universities in the UK only. Thus, they are very well aware of the university requirements and how students can fetch the highest grades in their assignments. That is why it is necessary to take expert help from experienced websites and EssayCorp has more than 8 years of experience in assignment services. Our website leads the market and assisted millions of students to boost their scorecards.

We all are very much aware of taxation, it is the duty or payment levied on an individual or an entity by the government. A certain percentage of the income is retrieved by the government, this money is used for infrastructure development and other initiatives taken by the government. Failing to do so or tax evasion is a punishable crime with the chances of imprisonment. The taxation in the United Kingdom changes every year under the law called Finance Act.

The demand for smart tax evaluators is on the rise, with the increasing complexity of the UK taxation this phenomenon was inevitable. The UK taxation has doubled in pages since 1997, it is now 11,520 pages. UK taxation is one of the world's most complex taxation systems. It is almost impossible for a student to obtain the highest grade in their tax assignment, given the complexity and the sheer volume of the subject. We here at EssayCorp are a specialist in UK taxation assignment help. We have provided taxation assignment help to numerous students from all over the country. We pride ourselves on our assignment writing service. We provide top-notch assignment help. Our UK native writers are specialized in their subjects and they are highly qualified as they hold Ph.D. degrees from recognized universities in the UK only. Thus, they are very well aware of the university requirements and how students can fetch the highest grades in their assignments. That is why it is necessary to take expert help from experienced websites and EssayCorp has more than 8 years of experience in assignment services. Our website leads the market and assisted millions of students to boost their scorecards.

The UK Tax System and Its Administration:

This topic defines the tax policy and its objectives, before moving on to the framework and method in public economics. This topic also looks to define the overall purpose and function of taxation in the modern economy, sources of revenue tax, the process of making the return, time limits in relation to various tax-related activities, the process in accordance with compliance, appeals, and disputes; and the penalty for non-compliance. This is an overview of topics that our experts cover under UK taxation assignment help for this chapter.

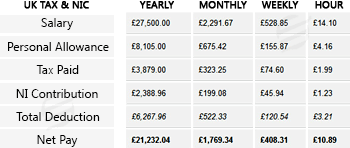

Under this topic, things that focus on income tax, topics covered under this are; the various scope of income tax, income from employment, property and investment income, self-employment income, the calculation of income tax and income tax liability, insurance, and deductions and relief on the tax liability. This topic teaches the student the methods of income tax calculations, our writers are adept and remain updated on a consistent basis. Therefore they are the best option for your UK taxation assignment help.

The primary focus of this topic is capital gains. Capital gains are the profit obtained from the sale of an investment or a property. The topics discussed are; the scope of taxation of capital gains, principles of calculating gains and losses, treatment of movable and immovable property, treatment of disposal of securities, calculation of capital gains tax, the exemption in the calculation of capital gains. The objective of this topic is to teach you the computation of capital gains and the various deduction available against your tax liability.

It is the tax levied on the inheritance of a property, money, or any other possession of an individual who is deceased. There are some exemptions to this tax, and several other things are taught under this heading. Some topics are; computation of transfer of value, liabilities on chargeable lifetime transfer, exemptions that minimize the inheritance tax liability, and payment of inheritance tax. In most of the topics of UK taxation, there are problems with the computation of tax, it causes problems for the student, so we at EssayCorp provide UK taxation assignment help.

Under this heading or topic, you learn what a corporate tax is all about and the method to calculate the corporate tax. The topics that are taught are; the entities that come under the corporate tax, taxable profits, gains of the companies that come under tax bracket, computation of corporate tax liability, exemption, and relief to minimize corporate tax liability. This is a very important topic as it weighs a lot in your assignment and also in the final examination. Our writers provide either the whole UK taxation assignment help or just the topic based homework help.

It is a tax levied on the various stages of production of a good and at the final sale, it is a consumption tax. The students learn things like; requirement of VAT registration, calculation of value-added tax liability, and special schemes. In many countries, this tax does not exist and is replaced by another tax called the goods and service tax. They are both the same type of tax, levied on the consumption of goods and services. Countries like Australia and the US have GST; recently India has moved on to the adoption of GST.

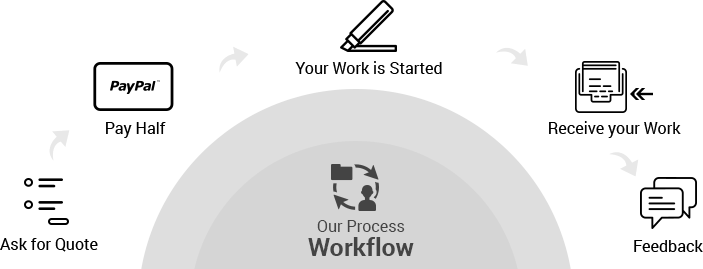

We provide a range of UK taxation assignment help, apart from the ones mentioned above. Our services include assignment writing, tax homework help, dissertations, thesis, essays, etc. We specialize in taxation law, as well as the whole subject UK taxation assignment help.

Problems Faced by Students with Taxation Assignment

Taxation is a difficult subject to study, there is an enormous amount of data available that can confuse the student. It is found that students often struggle with taxation assignments, not just in the UK but worldwide. And the difficulty for the UK students is even more as the taxation system in the UK is one of the oldest, dating more than a century back. Students struggle with the subject because of the convolution of topics and how all of them combine to blossom into a perfect solution. Like all the accounts and finance-related subjects, even in taxation, a student in most cases omits a point or two which results in a bad or lessened grade. Assignments are a vital part of any academic curriculum, they weigh a lot in your final grade; spearheading them is an absolute necessity. As the student is in a learning phase and not yet adept, it is unfair to expect a proficient assignment that is impeccably written and completely error-free, nonetheless, the colleges postulate that. We understand the dilemma of a student and that is why we provide UK taxation assignment help at a very reasonable price which is keeping the students in mind.

Get homework help anytime, anywhere!

Tutors are online 24/7 to help you in any subject.