The taxation process can be very complicated to understand at times, as each country has a specific taxation system. Students of Australia can find taxation overwhelming as it has the taxation system which is one of the highest in the world, it is based on the cumulative income of the country as well as that income which is earned overseas. This can get quite convoluted making it difficult for students to understand. Australian taxation assignments are not very easy to crack and students may require external help and support to understand the key concepts and processes of the taxation system in their country. So, the students who require the Australian taxation assignment help can approach us.

We are a premium assignment providing a company with extensive experience in the field of assignment writing. We are aware that the Australian taxation assignments can be taxing because of the sheer amount of information available on the net and a student more often than not gets confused in accordance with what data to Utilize and what to discard. We at EssayCorp have been providing several services related to academic writing for students in Australia, we can provide you with all kind of Australian taxation assignment help, our many services includes homework, thesis, dissertations, online tests, and much more. Our taxation expert writers are Australian native writers who work with proper concentration to meet the professors’ expectations from the assignments. They write not just with the motive of getting passed but with the motive of getting top grades among all the students in the class. We provide taxation assignments at the most affordable prices with a free Turnitin report attached with it.

The taxation process can be very complicated to understand at times, as each country has a specific taxation system. Students of Australia can find taxation overwhelming as it has the taxation system which is one of the highest in the world, it is based on the cumulative income of the country as well as that income which is earned overseas. This can get quite convoluted making it difficult for students to understand. Australian taxation assignments are not very easy to crack and students may require external help and support to understand the key concepts and processes of the taxation system in their country. So, the students who require the Australian taxation assignment help can approach us.

We are a premium assignment providing a company with extensive experience in the field of assignment writing. We are aware that the Australian taxation assignments can be taxing because of the sheer amount of information available on the net and a student more often than not gets confused in accordance with what data to Utilize and what to discard. We at EssayCorp have been providing several services related to academic writing for students in Australia, we can provide you with all kind of Australian taxation assignment help, our many services includes homework, thesis, dissertations, online tests, and much more. Our taxation expert writers are Australian native writers who work with proper concentration to meet the professors’ expectations from the assignments. They write not just with the motive of getting passed but with the motive of getting top grades among all the students in the class. We provide taxation assignments at the most affordable prices with a free Turnitin report attached with it.

Type of Australian Taxes and Complications in the Subject

It is a regular payment made to a fund by an employer towards a future pension of the employee and it is an Australian pension program. After retirement, the fund is collected and along with this one can use it with other incentives. These taxes are charged at three points and are also known as the 'three pillars.' According to the budget of 2007-2008, one need not pay anything to this fund if the age is 60 years. Otherwise, a flat rate of 15% is imposed on every working individual.

If a student faces a problem with the computation of superannuation taxes he or she can approach our adept team of writers to procure Australian taxation assignment help.

Unlike most countries that have a different tax slab for different revenue-generating companies, Australia has a 30% flat rate of corporate tax. All the companies including the corporates need to pay tax to the federal government for the profit earned. The tax is paid to the government prior to the distribution of dividends. The method by which the corporate tax is transferred to the shareholders and under which they can make deductions to their income tax is called Franking Credit or Dividend Imputation. A student can sometimes struggle with the method of calculation of corporate tax, as he may not know which information to use from the given question, so he can utilize our expert writers for Australian taxation assignment help.

The tax levied on the supply of goods and services in Australia is 10%. Good and service tax is imposed on the individual who is registered for the same. There are some commodities that are free from the implication of goods and service tax, commodities like; food products, exports, education-related services, and medical services. The tax that is collected is distributed equally among the states. Stamp duty is imposed by the govt. on some transactions and sales tax too.

This tax was introduced by the Haward Government on 1 July 2000. Goods and service tax is relatively new, so not many students fully understand it yet. We at EssayCorp have writers working for us from all over the world and for your particular Australian taxation assignment help, we will provide an Australian writer.

This tax is levied by the Australian government on inelastic goods like petrol, cigarettes, alcohol, etc. Inelastic goods are those, the demand for which is not affected by the change in price.

The financial expenditure of the government largely depends on the property tax, these taxes are collected from commercial complexes, residential complexes, and industrial houses. On occasions, the govt. levies tax on properties that are of very high value.

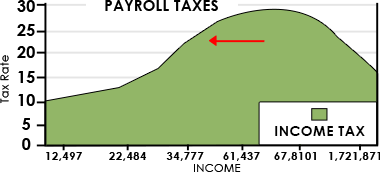

This type of tax is levied by the state government and it varies according to different circumstances. The federal government of Australia relies to a great extent on the funding of different activities on the income tax. It is a type of direct tax as it is directly imposed on the earning of the population if they fall in the tax bracket. This tax is more than a century old and quite complex to calculate. It involves many deductions and many sources of income need to be analyzed. Therefore, if you face trouble with Australian taxation or you just have some other engagement that needs your attention, you can avail of our services at a very affordable price.

| Taxable Income | Tax on this income |

|---|---|

| 0-$18,200 | NIL |

| $18,201-$37,000 | 19c for each $1 over $18,200 |

| $37,001 - $87,000 | $3,572 plus 32.5c for each $1 over $37,000 |

| $87,001 - $180,000 | $19,822 plus 37c for each $1 over $87,000 |

| $87,001 - $180,000 | $54,232 plus 45c for each $1 over $180,000 |

Following are not included:

Why do Students need Australian Taxation Assignment Help?

From the above table, it might seem easy enough to calculate the income tax but it is not, there are multitudes of things that come into play while calculating the income tax, for that very reason people hire experts to do their taxes. A simplified book like Rod Caldwell', 'Taxation for Australian business' has 232 pages. If you go for some detailed books that cover the entire Australian taxation, the pages are around 1300. So, getting that perfect score in your assignment on taxation is not impossible but very improbable. It would require your complete dedication, but it might affect your commitment towards other subjects. So, for your convenience, we provide the best Australian taxation assignment help.

A general book on Australian taxation contains topics like; determination of income, uniform capital allowance, deductions, partnership, capital gains tax, reconciliation from accounting profit for net income or tax, franking accounts and companies, trusts, and minors, etc. The toughness of some of the topic are of the intermediate level but others are quite complicated and difficult. To be able to complete an Australian taxation assignment the student must have a thorough knowledge of all the concepts and should make the calculation impeccably, a lapse in any calculation or an error could result in a negative mark in your assignment. Assignments are an integral part of securing the best grade, so we suggest that you seek the Australian taxation assignment help from us. And when you receive the assignment back from us, go over it, analyze how the problems are solved for a better learning experience.